SIP Growth Plus

SIP (Systematic Investment Plan): A SIP is a disciplined investment approach where investors contribute a fixed amount at regular intervals (monthly, quarterly, etc.) into a mutual fund. This allows investors to benefit from rupee cost averaging and the power of compounding.

Growth Plus: The term “Growth Plus” generally indicates a plan with a focus on growth-oriented mutual funds, aiming to provide higher returns through equity investments or other high-growth assets.

SIP Growth Plus is designed for investors looking to build wealth over time through systematic, growth-focused investments. It combines the benefits of disciplined investing with the potential for higher returns through equity investments.

Benefits:

1)Disciplined Investing: SIP Growth Plus encourages disciplined investing, which can be particularly beneficial for long-term financial goals.

2)Rupee Cost Averaging: By investing a fixed amount regularly, investors buy more units when prices are low and fewer units when prices are high, averaging out the cost of investment.

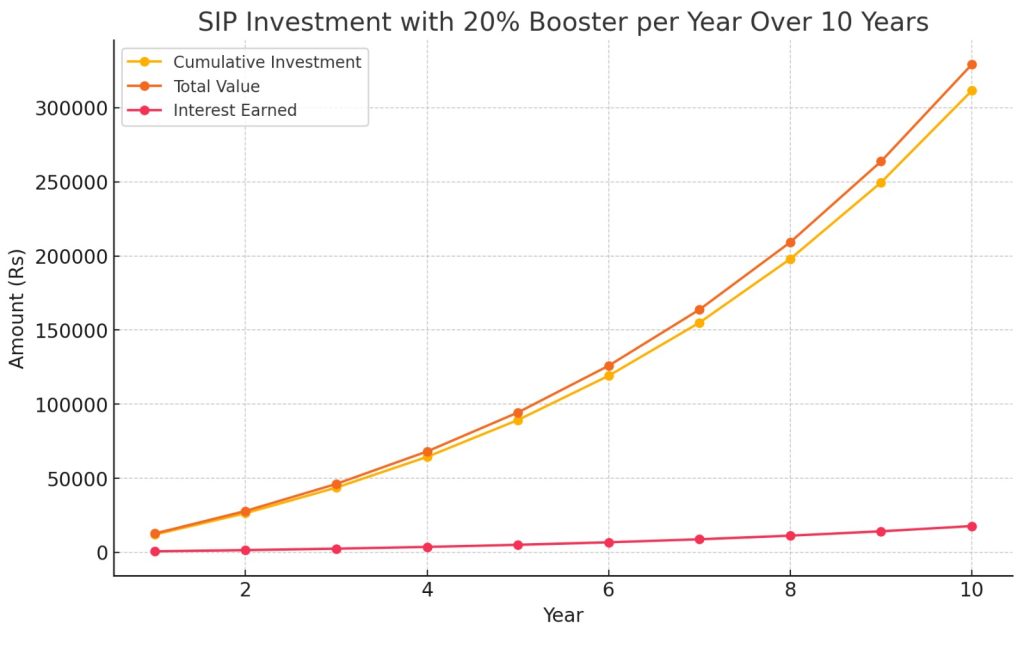

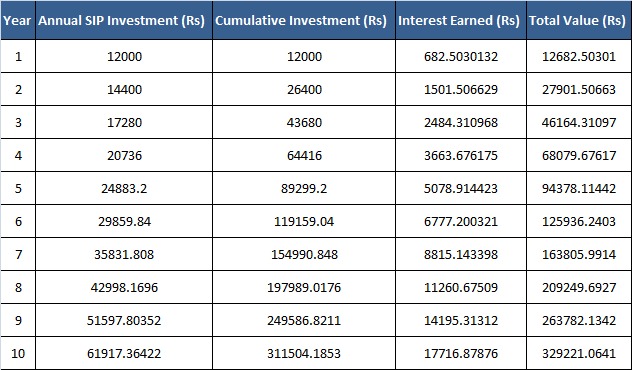

3)Long-Term Growth: The focus on growth-oriented investments aims to provide potentially higher returns over the long term, which can be advantageous for goals like wealth accumulation, retirement planning, or education funding.

4)Ease of Investment: SIPs are generally easy to set up and manage, often allowing for online transactions and automatic deductions from bank accounts.

Features:

1)Regular Investments: Investors make regular contributions at specified intervals. This helps in averaging out the purchase cost of mutual fund units over time, reducing the impact of market volatility.

2)Growth Focus: The “Growth Plus” component suggests that the invested funds are predominantly allocated to equity or equity-oriented securities. These investments aim for capital appreciation rather than regular income.

3)Compounding Benefits: Regular investments in a growth-oriented plan can benefit from compounding returns over time. The returns earned on the invested amount are reinvested, which can accelerate the growth of the investment.

4)Flexibility: SIP Growth Plus plans typically offer flexibility in terms of investment amount and frequency. Investors can increase or decrease their contributions based on their financial goals and market conditions.

5)Risk Profile: Since Growth Plus plans focus on equities or high-growth assets, they may have a higher risk profile compared to other investment plans that focus on fixed income or debt securities. Investors should assess their risk tolerance before investing.

6)Tax Benefits: Depending on the country and specific investment plan, there may be tax advantages associated with SIPs. For example, in India, investments in certain SIPs qualify for tax deductions under Section 80C of the Income Tax Act.

Keep Your Business Safe & Ensure High Availability.

Ever find yourself staring at your computer s good consulting slogan to come to mind? Oftentimes.

Ever find yourself staring at your computer screen a good consulting slogan to coind yourself sta your computer screen a good consulting slogan.

Ever find yourself staring at your computer screen a good consulting slogan to coind yourself sta your computer screen a good consulting slogan.

Ever find yourself staring at your computer screen a good consulting slogan to coind yourself sta your computer screen a good consulting slogan.

“ Morem ipsum dolor sit amet, consectetur adipiscing elita florai sum dolor sit amet, consecteture.Borem ipsum dolor sit amet, consectetur.

Mr.Robey Alexa

CEO, Gerow Agency“ Morem ipsum dolor sit amet, consectetur adipiscing elita florai sum dolor sit amet, consecteture.Borem ipsum dolor sit amet, consectetur.

Samuel Peters

CEO, Gerow Agency“ Morem ipsum dolor sit amet, consectetur adipiscing elita florai sum dolor sit amet, consecteture.Borem ipsum dolor sit amet, consectetur.